Swing trading has always been one of the most flexible ways to trade stocks, but in 2025, market volatility and new sector trends have made it even more exciting. Whether you’re a working professional who can’t watch charts all day or an active trader looking to diversify strategies, swing trading offers opportunities to capture moves lasting from a few days to a few weeks.

At JSR Analytics, we believe financial learning should be simple, actionable, and profitable. In this guide, we’ll break down exactly how you can spot profitable swing trade setups in today’s Indian stock market.

What is Swing Trading and Why It Works in 2025

Swing trading is about capturing short-to-medium-term trends without the stress of minute-by-minute monitoring. In 2025, with rapid news flow, RBI policy shifts, and sector rotations, swing traders can capitalize on trend momentum before it fades.

Key benefits of swing trading in the current market:

- Works even in sideways or moderately trending markets

- Requires less screen time compared to intraday

- Fits perfectly for working professionals

- Allows better risk-reward setups

Core Tools You’ll Need for Swing Trading in India

Before jumping into strategies, make sure you have:

- A TradingView account for charting

- A broker account with NSE/BSE chart access

- A scanner (like ChartInk) for stock filtering

- Basic understanding of candlestick patterns

Swing Trading Strategy for the Current Market

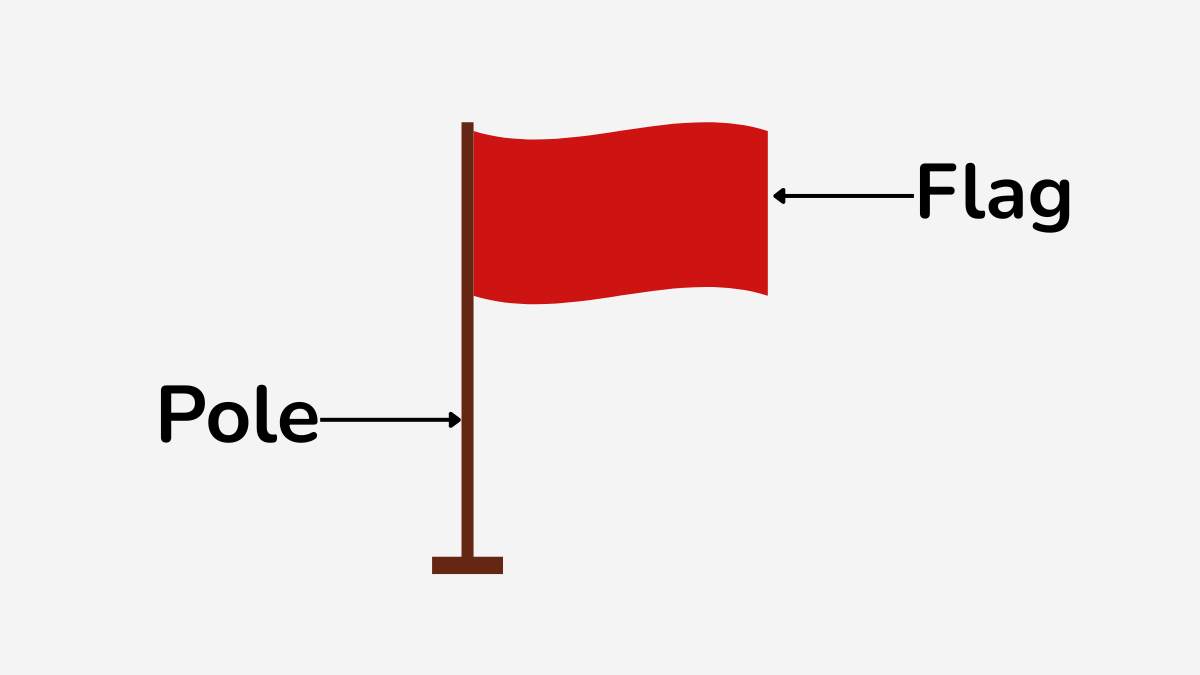

Step 1 – Identify the Flag Pattern

The bullish flag is one of the most reliable patterns in 2025 due to high sector momentum.

- Flagpole: Sharp rally in price

- Flag: Small, downward consolidation

- Breakout: Price moves above consolidation with strong volume

Step 2 – Use EMA for Trend Confirmation

We recommend the 20 EMA as your dynamic support:

- Price above 20 EMA → bullish

- EMA sloping upward → trend strength

- Avoid trades where price is far from EMA (overextended)

Step 3 – Volume Analysis

Low volume during consolidation → healthy pullback

High volume breakout → strong continuation

Step 4 – Risk Management

Entry: On breakout above flag high

Stop-loss: 5% from entry price

Target: 8–10% gain

Common Mistakes to Avoid

Entering before confirmation

Ignoring broader market trend

Risking more than 2% of total capital per trade

Overtrading in volatile markets

Final Thoughts

Swing trading in 2025 is about pattern recognition, patience, and discipline. The tools are there, the opportunities are plenty, all you need is the right approach.

At JSR Analytics, we simplify trading education so that anyone can learn to trade with confidence. If you’re ready to take your swing trading skills to the next level, check out our upcoming Swing Trading Mastery Course designed for current market conditions.

Also you will learn in depth concepts and how can you find the stock which are forming such patterns.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.